1.3.25 Tredas Weekly Recap

Weekly Action:

March25 Corn down 3 at $4.51

March25 Beans down 2 at $9.92

March25 KC Wheat down 17 at $5.38

Feb25 Hogs down 3.20 at $80.80

Feb25 Fats up 2.97 at $194.025

Jan25 Feeders up 7.275 at $267.75

Dec25 Corn flat at $4.41

Nov25 Beans up 1 at $10.06

July25 KC Wheat down 17 at $5.67

Grains:

This week’s Commitment of Traders will be released Monday due to the New Year’s holiday. Look for next week to be choppy as traders gear up for the January WASDE. This will be the last time USDA looks at US production from the last growing season.

U.S. corn export commitments for the crop year (Sep 1-Aug 30) are 1.528 billion bushels, which is 30% more than last year’s 1.173 billion bushels at this point last year vs the USDA's 2.475 billion bushel export projection. This reflects an expected 8.0% increase in exports from last year. To reach the USDA's export projection, it is estimated corn sales will need to average roughly 24.2 mil bu/week through the end of August vs last year's 29.2 mil bu/week average from this point forward.

U.S. soybean commitments of 1.476 billion bushels are up nearly 11% from last year's 1.335 billion bushels for this week last year. USDA's 1.825-billion-bushel export projection reflects an expected 7.7% increase in exports from last year. To reach the USDA's export target, we estimate soybean sales will need to average roughly 9.6 mil bu/week through the end of last year, identical to last year's average sales from this point forward. China now has only 2.8 MMT in unshipped purchases still on the books vs 5.2 MMT unshipped at this time last year.

U.S. wheat commitments of 621 million bushels are up nearly 11% from last year's 561 million, with sales needing to average roughly 9.1 mil bu/week through the end of May to reach the USDA's 850-million-bushel export projection which would be notably stronger than last year's minimal 5.6 mil bu/week average sales from this point forward. With the expected notable decline in Ukraine/Russian exports from Feb forward, an increase in sales relative to last year is possible but will need to be watched closely.

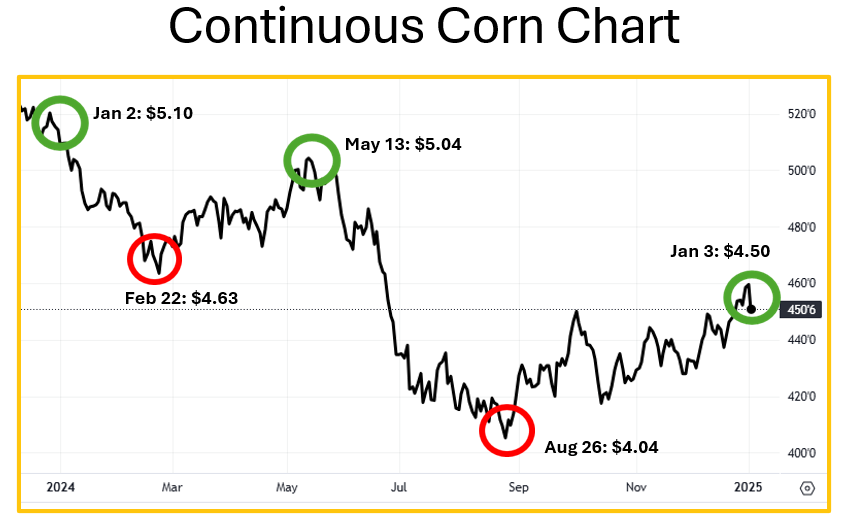

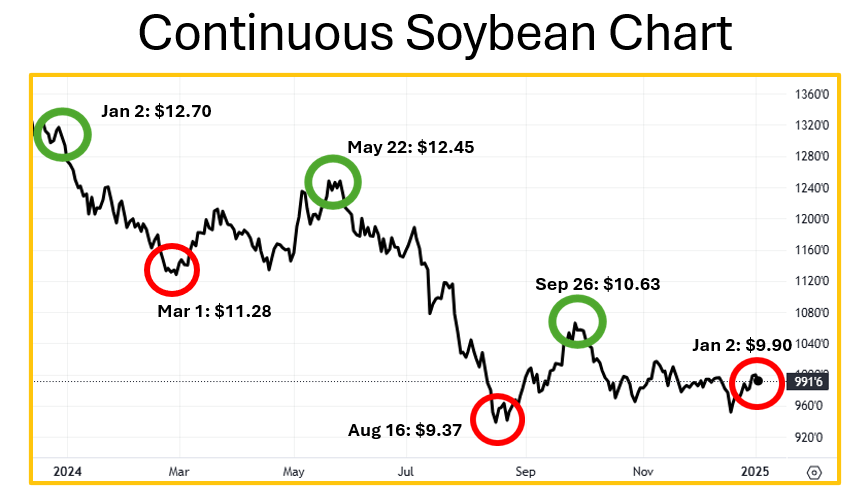

Wrapping up 2024, below are the continuous charts of several commodities. The big takeaway from this is markets ebb and flow. All commodities below offered opportunities for success and peril. Remember, no one knows where the market will go but when you have opportunities it is wise to manage them!

Weather:

Limited rainfall is projected for Argentina and Southern Brazil the next ten days. Central and Northern Brazil weather remains favorable and yield potential remains high.

Economy:

The S&P 500 posted a 24% gain in 2024. It has risen 53% the last two years, it’s largest two-year gain since 1997.

The S&P 500 outperformed the equal weight index by 12% in 2024 after 12% outperformance in 2023. The only consecutive years with a higher combined outperformance than 2023-2024? 1998-1999.

Just 10 stocks account for 38% of the S&P 500 total market cap. The only other time this has happened was just before the Great Depression.

A record 771,480 people were reported homeless in the US in 2024, an 18% increase over 2023.

This is the first time in history when 100bps of rate cuts raised 10Y treasury yields by 100bps. “The market” does not believe inflation is cooling as much as the FED.

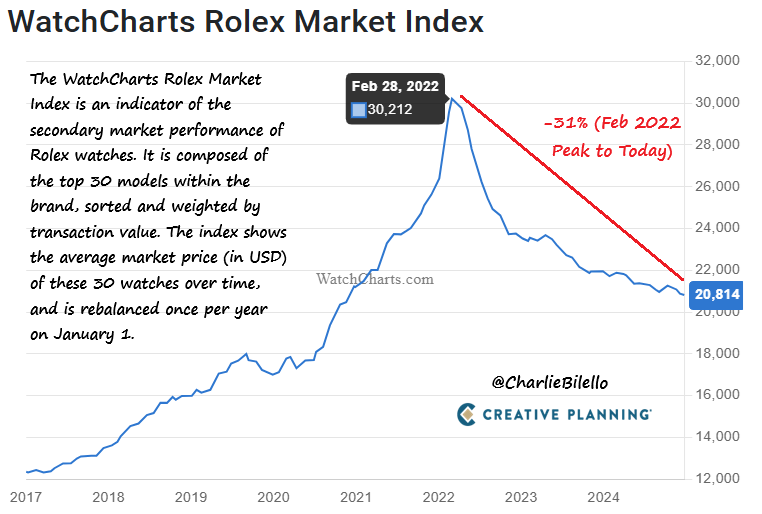

Something that probably means nothing:

An index of Rolex Watch Prices is at its lowest since November 2020, down 31% from the peak in March 2022.

Quote of the Week:

“Don’t live the same year 75 times and call it a life.” – Robin Sharma

Enjoy your weekend!