9.6.24 Tredas Weekly Recap

Weekly Action:

Corn Dec24 up 5 at $4.06

Beans Nov24 up 5 at $10.04

KC Wheat Dec24 up 11 $5.77

Hogs Oct24 down 2.60 at $79.65

Fats Oct24 down 3.375 at $175.30

Feeders Oct24 down 6.60 at $231.225

Corn Dec25 up 5 at $4.44

Beans Nov25 up 5 at $10.50

KC Wheat July25 up 11 at $6.00

Market Recap:

Grains rallied out of the long weekend before finding resistance levels and closing Friday with modest weekly gains. The 20-day moving average (MA) has suppressed both corn and beans for the last 2 months. Breaking through that resistance last Friday was encouraging. Dec Corn faltered after breaking through its 50-day MA around 410. Nov Beans bounced off their 50-day during the Friday session and retreated. The 2-week rally has kicked many technical indicators into “sell signal” territory.

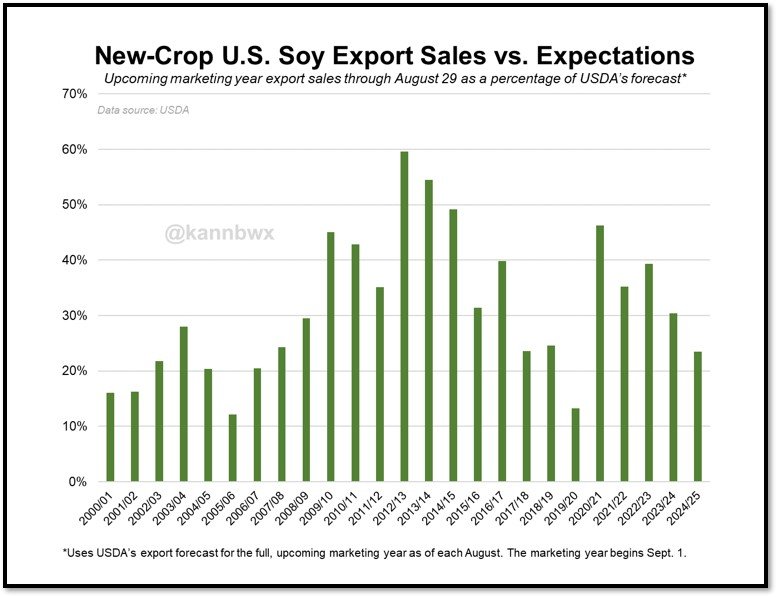

The U.S.’s heavy balance sheet needs a catalyst to bring grains off their multi-year lows. The harvest export window will offer opportunities, especially as Chinese crush margins improve, but current sales volume isn’t encouraging. The following charts from Karen Braun on X show current export sales volumes compared to USDA forecasts.

Looking ahead, next week’s Crop Progress report (Monday) and WASDE (Thursday) will be the big market movers in the short-term. Markets will need to see the USDA’s soybean yield to determine if the Nov contract’s 60+ cent recovery was justified or if we’ll retest the $9.55 lows.

Weather:

The month of August was drier than usual across much of the corn belt, accelerating maturity and reducing top-end yield potential.

The 10-day forecast doesn’t appear to offer any changes to the trend.

Dryness and heat in South America have also been drawing attention. This little moisture isn’t unheard of during their dry seasons, but without moisture built into the long-term forecasts, it could create planting issues as we get later into September.

Economy:

Labor reports have dominated economic news this week. The data will guide the Fed’s decision on how steeply to cut interest rates in this month’s meeting.

Job growth was positive month-over-month, but slightly below expectations. The unemployment rate declined following 4 months of increases. Analyst consensus is currently for a quarter-point rate cut at the next Fed meeting.

Something that probably means nothing:

The state of Colorado is named after the Spanish ‘colorado’ meaning “colored red” which describes the reddish sediments carried by the Colorado River.